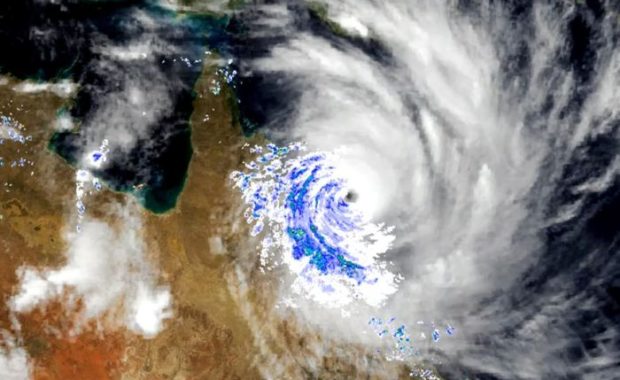

Five years ago thousands of north Queenslanders bunkered down for what would be one of the biggest cyclones to ever hit the coast. Cyclone Yasi, packing winds of up to 285 kilometres per hour, bore down on the tropics with the eye striking between Innisfail and Cardwell about midnight on February 3, … [Read more...] about Cyclone Yasi: Action urged to address skyrocketing insurance premiums in wake of disaster